Many people get confused about the tax filing process in general. They often mistake filing taxes for meaning they have to pay taxes. Oftentimes, I have had to explain the difference to taxpayers, especially when they are told that they have to file their taxes, irrespective of whether they earned any income or arrived on the last day of the year.

Just like a number line, filing your taxes can land you on either side of the line, so whether you end up owing taxes or receiving a refund depends on various factors. In this article, I will explore some of the situations that can lead to a tax payable.

Understanding Tax Filing versus Tax Payable

First, let’s clarify the difference between filing taxes and paying taxes. Filing your tax return is mandatory for most Canadians, even if you have no income or owe no taxes. Think about it as submitting a financial summary of your activities as a tax resident of Canada to the Canada Revenue Agency (CRA).

Being a tax resident means you have this responsibility every year, and the essence is also for the government to understand its responsibilities to you.

For example, if you live in Canada and never file your taxes, you will never receive any benefits or credits that you are entitled to, such as the GST/HST credit, Carbon Credit Rebate, the Canada Child Benefit, and many others.

So, what situations can lead to a tax payable?

- You owe the government

- The government owes you

- No one owes the other

When You Owe the Government

Owing the government basically means that your total income exceeds your eligible expenses and tax already paid. Taxable income is the portion of your income that the government can tax. You read that right, not all your income is typically taxable. This is because the government understands that some expenses are incurred for income to be earned. These expenses are referred to as eligible expenses. As an employee, these expenses are limited to what your employer permits you to deduct, mainly because every other resource needed to complete your job has been provided. Certain expenses are, however, permitted by the CRA. An example of such an expense is the cost incurred when moving from one point to another for employment purposes. You can read about these in detail here.

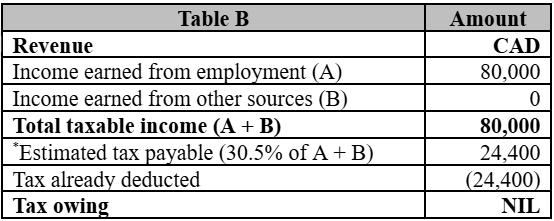

If David worked with TaxWhiz from January 1 to December 31, 2024, earning a gross pay of CAD 80,000 with a total of CAD 24,400 deducted as taxes, David’s taxable income will be CAD 80,000 even though he only took home CAD 55,600 (CAD 80,000 less CAD 24,400) cumulatively during the year.

However, when David is filing his taxes, the CAD 24,400 already deducted as taxes will be factored in, bringing his taxable income to zero – this is with the assumption that his employer deducted the right amount of taxes, and David has no other income to declare or expenses to deduct.

When the Government Owes You

The government owing you means you are in a refund position. A refund position can arise when your eligible expenses are higher than your total income, and/or when there are applicable tax credits. Depending on the taxpayer, eligible expenses can be childcare expenses, professional dues, moving expenses, employment expenses, as well as contributions to registered accounts like RRSP and FHSA. Credits like donations and gifts, medical expenses, etc., can also be applicable.

Using the example in Table C above, if David had a total eligible expense of CAD 75,000, his total taxable income would become CAD 75,000 (CAD 150,000 less 75,000), which when applied on his return, would likely put him in a refund position as the total taxes already deducted could be more than what is due.

When No One Owes Anything

Now to the simple part where no one owes the other. Recall our first example in Table A, where David had no tax owing as the exact amount of taxes due on his income for the year had been deducted from his pay by his employer. This situation best explains this point. Although it is quite uncommon to find yourself in this situation due to several tax credits that are due to the average tax resident in a year, it is imperative that I explain this.

For example, an individual who earned $173,205 or less in the 2024 tax year will be due a maximum federal basic personal amount of $15,705, which means a person can earn a taxable income of $15,705 in 2024 without paying any federal tax. Depending on the province they live in, they may also not pay any provincial tax if they earned between $8,481 to $21,885.

Can this situation be avoided?

I’ll say not in all cases, but the good news is that the risk of owing additional taxes when filing one’s tax returns can be minimized.

- Adjust Tax Withholding: Ensure your employer withholds the correct amount of tax from your paycheck. You can do this by submitting Form TD1 to your employer and requesting adjustments to the taxes that are being withheld. This adjustment will take into consideration any additional income earned from a different employer and ensure that the marginal difference in taxes is deducted.

- Make Installment Payments: If you have significant self-employment or investment income, you can make quarterly payments to the CRA to cover your potential tax liability. Any overpaid taxes will be refunded by the CRA after your returns are assessed.

- Make Plans: This is arguably the best approach, as it means you would have made plans for the potential tax by setting the amount aside as they become due. As a bonus, this amount can be invested in a fixed plan to generate additional income before the tax payment is due.

Bottom Line

Understanding the difference between filing taxes and paying taxes is essential for managing your finances effectively. Knowing why you need to file your taxes and how the situations that can lead to a tax payable can help you take proactive steps to manage your tax obligations.